That was one of the first questions we asked ourselves.

To answer that question, we considered that we’re “selling everything” to embark on Residential Cruising for an undetermined number of years. That means that we could eliminate quite a few things that have long been part of our ongoing budget:

- Home mortgage, insurance, property taxes, utilities, and repairs/maintenance.

- Two cars and their insurance, taxes, fuel, and maintenance.

- Our entire grocery budget, as well as little home appliances and grill, pots/pans/knives/utensils, etc. that need to be replaced from time to time.

- Entertainment and the occasional dinner out.

- And some medical expenses we won’t have aboard ship, where routine doctor visits are included (cruise packages vary, so research this).

For us, it all added up to around $7,000/month, or more than $230 per day, much of which we still had to pay when we traveled! Which is to say, for every day we were on the road, our daily costs were nearly double the usual ongoing budget. Yikes.

What if we simply sold all of these things (which would greatly reduce our stress and time demands), invest the proceeds, and lived aboard a ship going from country to country?

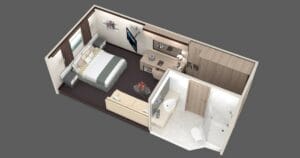

Some ships advertise that their lowest-cost options are $79/person/day — $158/day for a couple. That’s for a tiny inside cabin, but that’s quite a bit less than we pay now. We plan to opt for a slightly larger cabin with a balcony, which is more, but still in the range of our current daily expenses.

Hmmmmm!

Our Answer: We Indeed Can Afford It

By selling our house, cars, “stuff,” and eliminating countless monthly expenses, we realized that there is nothing stopping us from chucking it all to “Travel the World, Go Home Every Night™,” and that we’d have a fair amount of cash in the bank after selling everything (or, really, invested in a way that produces monthly income). And much of those savings wouldn’t be drawn upon for some time because we’d still be working.

An intriguing thought, isn’t it?

Sure, we’re going from a 2,400-square-foot house on 40 acres with exquisite mountain views to a tiny apartment, but we will have free use of a medical clinic, gym, restaurants, shows/other entertainment, mind-stimulating lectures, and more — all within a short walking distance. Not to mention getting off the ship at a multitude of ports to wander around new places.

What If Business Declines?

Besides having lots of savings once everything sells, what happens if business takes a hit while we are out and about as Digital Nomads? Well, we’ve already been through that recently: Covid-19 hit us hard, business-wise, but we survived, and business has been recovering more and more as Covid recedes.

Inflation has also bitten us a bit, business-wise, but even if outside income stopped completely overnight (not at all likely), we have that savings and will have, in a few years, the ability to draw on our Social Security — and still not touch retirement accounts, which can continue to grow in the meantime.

I won’t say “We’ve got it made no matter what,” but financially, we’re in the same position, or better, as where we would be if we stayed put in our house. The risk doesn’t seem that much higher, and in some ways it’s definitely lower.

Lessons Learned?

We realize that we’re very fortunate, but didn’t take it for granted that we could afford this. We sat down and added up actual expenses with the help of a spreadsheet to keep everything in order and the math accurate, and determined what it really costs for us to live where we have been for the past 20 years.

So that’s where we suggest you start.

Last Updated July 24, 2023

Originally Published July 24, 2023

- About the Author

- Latest Posts

Randy is the co-founder of Residential Cruising, and is best known as the founder of the oldest entertainment feature on the Internet, This is True. He and his wife, Kit, are moving to a full-time Residential Cruising ship in July 2024, where they will be “Digital Nomads” — continuing their work while aboard the ship.

“We plan to opt for a slightly larger cabin with a balcony, which is more, but still in the range of our current daily expenses.”

Note that Life at Sea starts at $38Kppdo, or about $6400/month for two people, but according to their price list a balcony cabin is $98Kppdo, or about $16K/month, well more than your $7K/month land expenses.

—

Yep: Life at Sea dropped out of our list of possibilities because of that. It’s quite a hefty jump. Luckily the sector is ramping up pretty quickly, and there are alternatives. -rc

Would you share that actual expenses spreadsheet? I would love to benefit from the research you have done to derive that spreadsheet. I am sure that it includes expenses I haven’t planned for.

—

I’ve added that to the article queue. Thanks for the suggestion. -rc

I can envision This is True as a weekly or more often option. My fave Dell hell piece is great entertainment. You get a discount with every talk. They should comp you a day per talk. That’s what I think you guys are worth but then it isn’t my business.

—

A day per talk?! I’m not that cheap! -rc

I really admire what you are doing.

Have you thought about the future though? ie. What happens, say a year down the line, the company decides to fold as it is not making as much profit etc?

Do you have any insurance should this happen?

—

Insurance against bad business practice? I don’t think there’s any such thing. Worst case scenario is we get off somewhere and fly back to the U.S., but I don’t think they’re going to launch if they don’t think they’ll make a profit, and I don’t think they’ll buy a ship if they don’t think they’ll launch. And they have a ship. -rc

Just because they think they will make a profit doesn’t mean that they *will* make a profit. There are any number of things that could be wrong about their predictions, especially because on the customer side this is a totally-new industry. (Running cruise ships is well-established. Selling cabins by the month or year isn’t.)

But rental-based scheme are sort of self-insuring; the worst case is an abrupt shutdown that loses you whatever you’ve pre-paid.

The problem is larger for buy-in schemes, though presumably in those you would still own a fraction of the ship when it’s sold.